The most trusted data for senior housing and care.

NIC MAP Vision is the premier provider of unbiased national and local market data for the senior housing and care sector, trusted by more than 5000 customers and 30 of the 50 largest owners and operators.

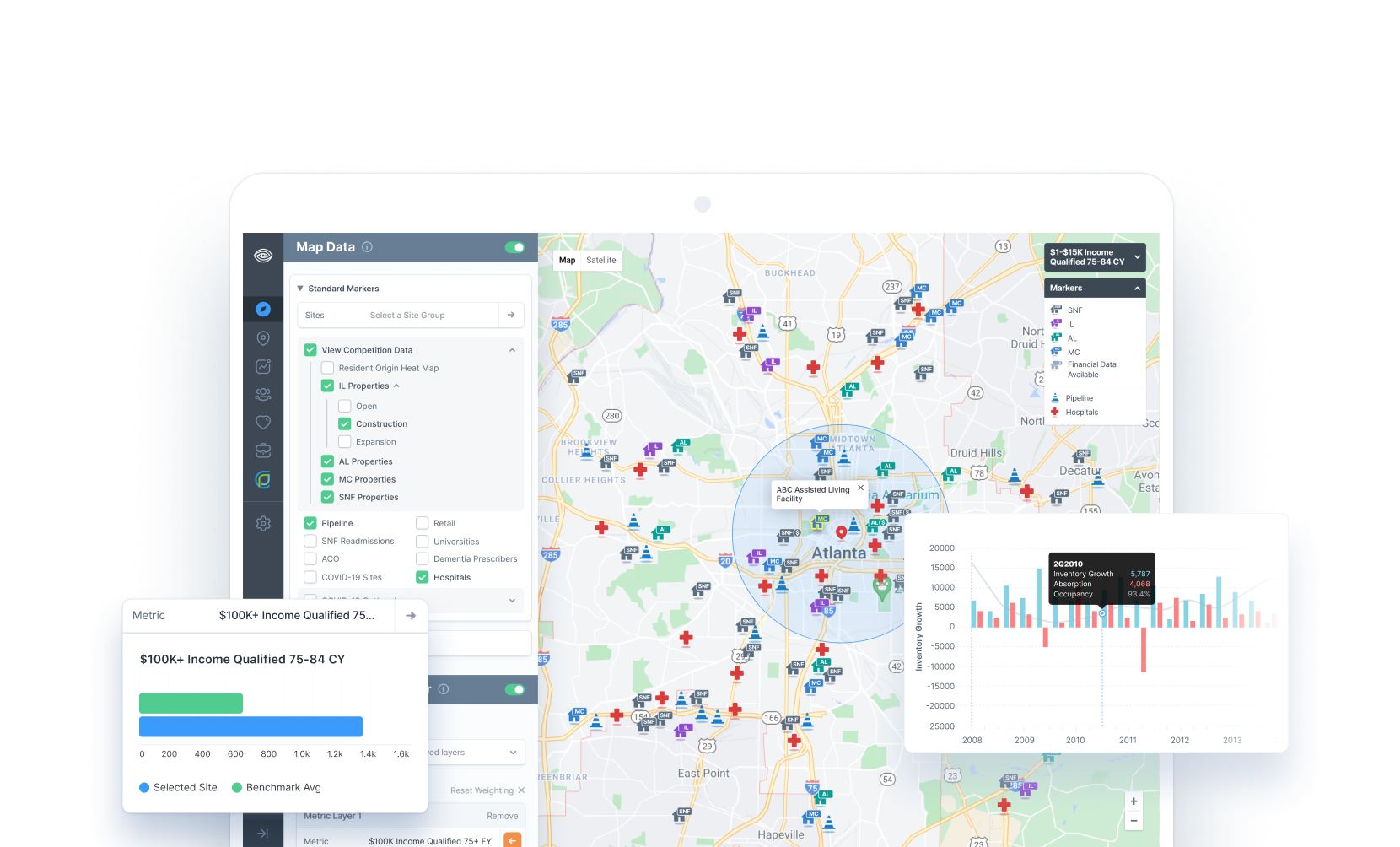

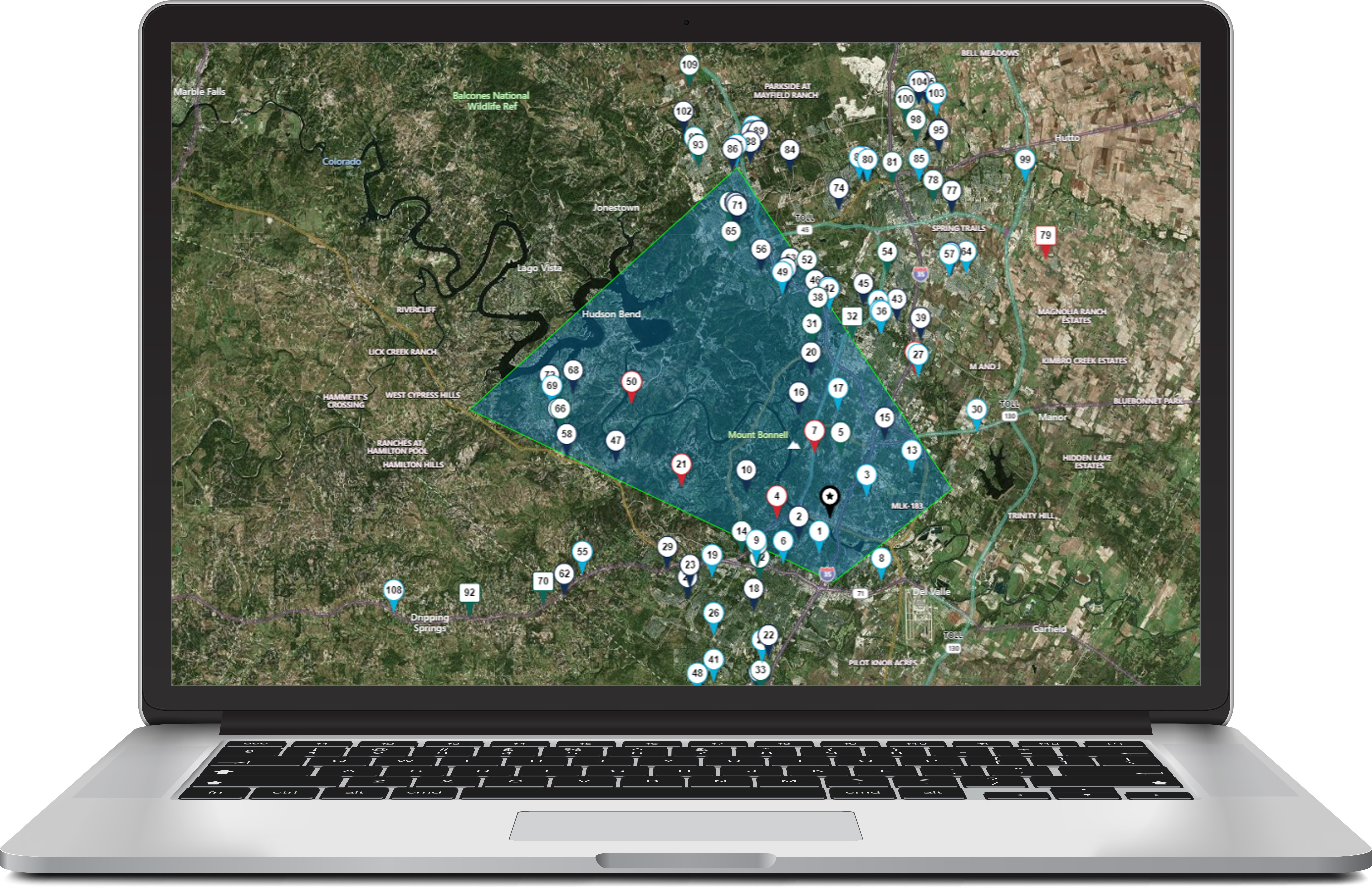

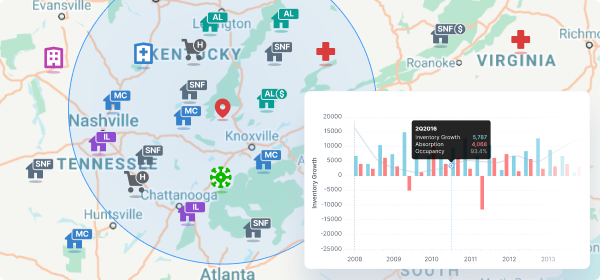

Whether you’re an operator, investor, capital provider, consultant, broker, financial intermediary, developer, or third-party vendor, NIC MAP Vision enables you to rapidly analyze any market, site, portfolio, or community.

Learn more about how our subscription service offerings can help support your business and save you time in an increasingly competitive market.

Designed exclusively for senior housing and care.

Created exclusively to serve the needs of the senior housing and care sector, NIC MAP Vision is the sector’s original data analytics platform. Our data and analytics tools help you make decisions more confidently and in less time.

Data Included?

- Sales Transactions

- Hospital Locations

- Existing Stock

- Construction Pipeline

- Occupancy & Rate Comps

- Demographics

- Property Characteristics

- and more!

How Often is the Data Updated?

Broken down by property type, care segments, and unit type, NIC MAP Vision is updated quarterly, monthly, and weekly varying by data set.

How often is the data updated?

Use a Trusted Service

Feel confident knowing you use data from senior housing’s first model of unbiased, dependable data, trusted by the industry for more than 15 years.

Gain Actionable Data

Make informed decisions by having the market intelligence you need.

Save Time

Run complex analyses in minutes, including the ability to analyze thousands of markets at scale.

"NIC MAP Vision is indispensable and important to our business because it gives us the first look into a market that we otherwise have very limited information on. It also gives us information that is specific to our interests in the seniors housing industry, and in a demographic we look to target."

- Axel Guerra, Director of Acquisitions & Development at Kisco Senior Living

"NIC MAP Vision is really indispensable for us because it allows us speed and efficiency, whereas there wasn't a product that allowed us to do that previously."

- Ryan Chase, Partner and Executive Managing Director at Blueprint

"I would tell anyone who's interested in investing in NIC MAP Vision, that it is a great investment if they seriously want to be a player in the senior housing industry."

- Anne Hampton, Managing Director with Wells Fargo

"We see the actual rates program as our top strategic priority. It is truly foundational to the the data that is the lifeblood of the senior housing industry."

- Arick Morton, CEO at NIC MAP Vision

"It's indispensable because it's continuously updated and expanded, and the quality of the data collection and verification for a published database is extremely good."

- Alice Katz, President, The Vinca Group

"NIC MAP has become the standard for the industry."

- Colleen Blumenthal, Managing Partner, Health Trust

"The biggest assets that it brings to us includes the inventory of independent living buildings, the list of licensed communities in a market, and the communities that are under development."

- Alice Katz, President, The Vinca Group

"It's depth. It's scope. It's all the markets in the United States that we're interested in. So no other data service provides the level of information that NIC Data Service provides."

- Justin Dickinson, Senior VP, CA Senior Living

Talk to a NIC MAP Vision representative today!

Fill out the form below to be connected with a representative who will quickly assess your business needs, suggest next steps, and schedule a demo with a product expert for a deeper dive.

NIC MAP Vision Benefits

Use a Trusted Service

Feel confident knowing you use data from senior housing’s first model of unbiased, dependable data, trusted by the industry for more than 15 years.

Gain Actionable Data

Make informed decisions by having the market intelligence you need.

Save Time

Run complex analyses in minutes, including the ability to analyze thousands of markets at scale.

What data is included?

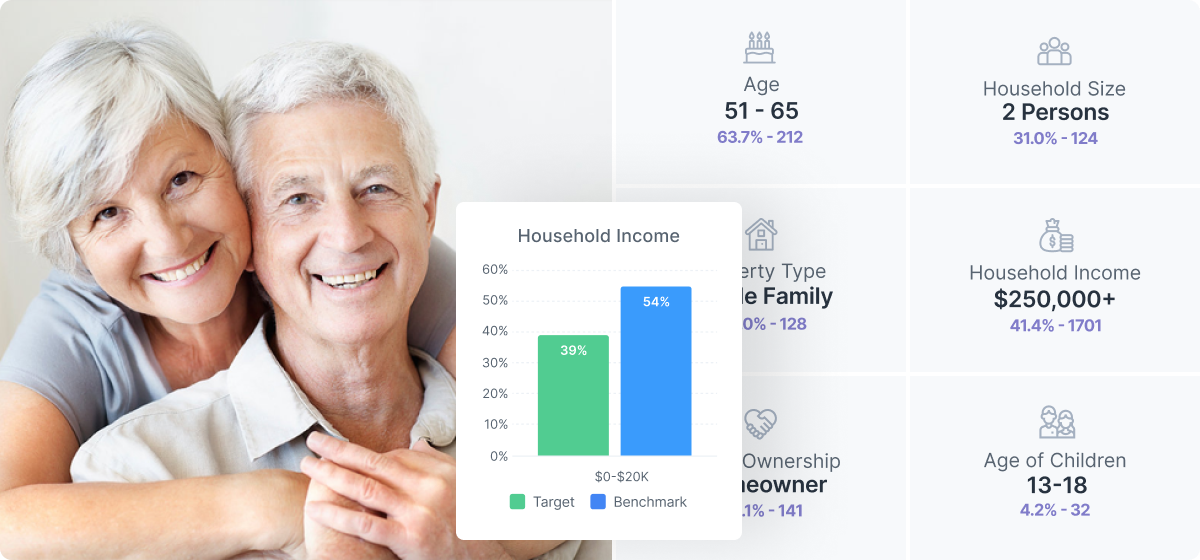

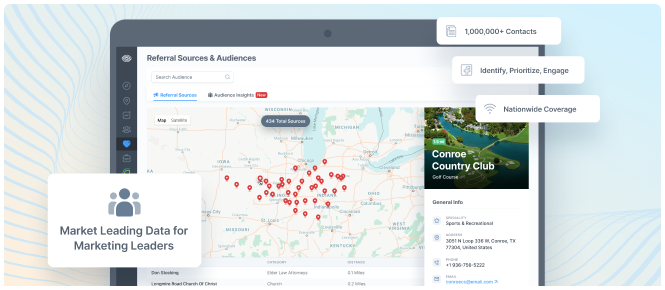

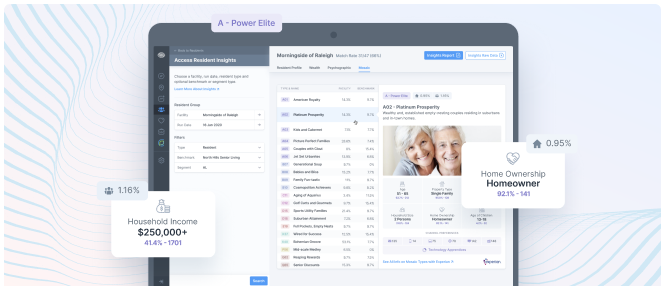

- 1 billion+ demand and demographic data points, including resident wealth, disability rates, and income

- 15+ Years of historical market data

- Rate and occupancy data for 140 markets

- Origin and migration trends 1.5 million+ senior housing residents

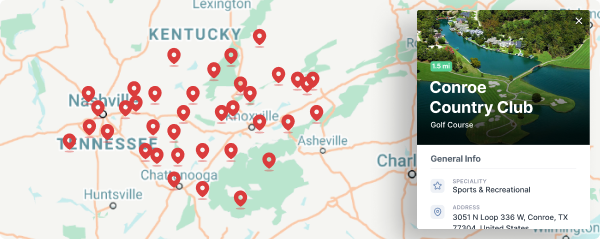

- 35,000+ properties nationwide with inventory data

- Resident migration patterns and psychographics

- Timely labor data based on current position listings

- CMBS financial data for 30% of senior housing units with original loan amounts, current loan balances, interest rates, and other metrics

- Property-level sales transaction activity updated weekly, including a detailed view into $200 billion closed transactions

- Construction pipeline information

- Healthcare utilization of Medicare beneficiaries

- And more